BTC Price Prediction: Path to $200,000 Amid Volatility

#BTC

- Technical indicators show BTC near oversold levels but below key moving averages, requiring a break above $115,000 for bullish momentum.

- Institutional accumulation and positive analyst forecasts (e.g., JPMorgan's $126,000 target) support long-term growth toward $200,000.

- Short-term volatility from patterns like the conference indicator may delay gains, but macro trends favor eventual upside.

BTC Price Prediction

Technical Analysis: BTC Testing Critical Support Levels

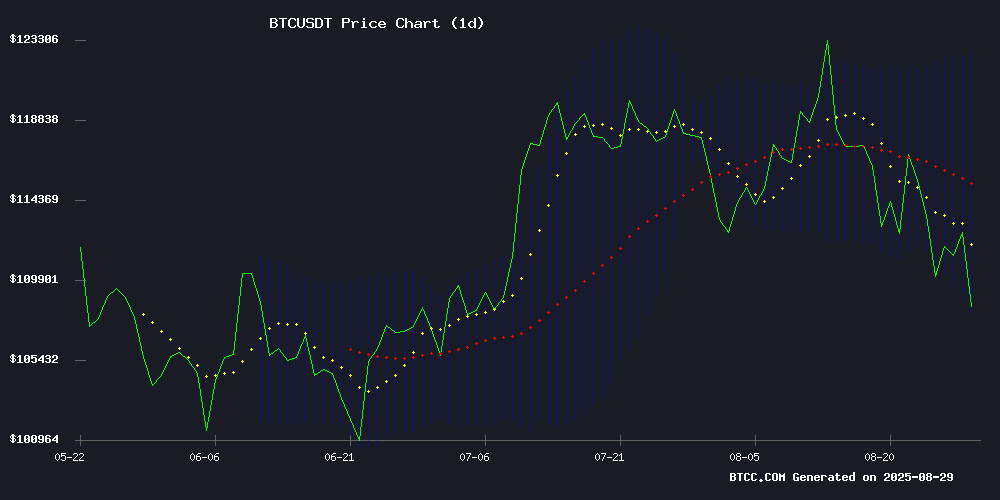

BTC is currently trading at $108,285, below its 20-day moving average of $115,378, indicating short-term bearish pressure. The MACD shows a positive momentum with the histogram at 1,821, though the price remains NEAR the lower Bollinger Band at $108,021, suggesting potential oversold conditions. According to BTCC financial analyst Sophia, 'A sustained break below $108,000 could see further downside toward $105,000, while reclaiming $115,000 may signal a recovery toward $120,000.'

Market Sentiment: Mixed Signals Amid Institutional Accumulation

News headlines reflect a divided sentiment. Positive catalysts include BlackRock's $51 million accumulation and JPMorgan's undervaluation call targeting $126,000. However, concerns persist with Bitcoin testing $110K support and hitting 7-week lows. BTCC financial analyst Sophia notes, 'Institutional buying and macro predictions like CZ's $1 million forecast provide long-term optimism, but short-term volatility remains due to technical patterns and market cycles.'

Factors Influencing BTC’s Price

Bitcoin Tests $110K Support Amid BlackRock's $51M Accumulation

Bitcoin's price stability at the $110,000 support level coincides with BlackRock's latest institutional move—adding $51 million in BTC to its fund wallets. Market data reveals over 90% of circulating supply is now profitable, a historically volatile signal.

CryptoQuant metrics show extreme profitability often precedes corrections as holders take gains. The current pattern mirrors 2025's cycle, where similar conditions triggered retracements before renewed upward momentum.

Institutional demand defies short-term cautionary signals, with BlackRock's accumulation underscoring long-term conviction. Blockchain activity suggests whales are positioning through the volatility, viewing dips as strategic entry points.

Top Bitcoin Casinos with Low Minimum Deposits in 2025

Bitcoin casinos continue to attract savvy players with their low entry barriers, offering minimal deposit requirements without compromising on transaction speed or privacy. Platforms like BitStarz and Jackbit lead the pack, catering to both newcomers and seasoned gamblers seeking to test the waters with modest investments.

BitStarz, a veteran in the industry, sets the gold standard with a minimum deposit of just 0.0001 BTC and a generous welcome bonus of up to 5 BTC plus 180 free spins. Jackbit, meanwhile, eliminates minimum deposit thresholds for top cryptocurrencies, refunding 100% of the first bet as part of its welcome package.

While low deposits provide accessibility, players must scrutinize terms and conditions to ensure bonuses align with their expectations. The market's competitive landscape ensures robust options for those prioritizing value and security.

Bitcoin Eyes $116,000 Bounce as CZ Predicts $1 Million This Cycle

Bitcoin is testing key support at $107,000, with potential for a rebound toward $116,000 if the level holds. Market sentiment remains cautiously optimistic as Binance CEO Changpeng Zhao (CZ) predicts BTC could reach $1 million this cycle, injecting fresh enthusiasm into the crypto community.

Derivatives data shows a minor pullback, with open interest holding steady and long-short ratios balanced. At press time, BTC trades at $109,945, down 2.61% over 24 hours, amid a daily volume of $49.27 billion. The asset's $2.18 trillion market cap underscores its dominance despite recent volatility.

Analysts are closely monitoring price action, with technical signals suggesting short-term caution even as long-term bullish narratives gain traction. CZ's provocative forecast has reignited debates about Bitcoin's cyclical potential, though immediate focus remains on the $107,000 support zone.

Bitcoin Slumps Below $109K as Conference Indicator Repeats Historical Pattern

Bitcoin's price action has once again mirrored historical trends surrounding Bitcoin Magazine's annual conferences. The digital asset tumbled below $109,000 during and after the 2025 U.S. Bitcoin Conference in Las Vegas, continuing a well-documented pattern of poor performance around these events.

The phenomenon stems from predictable market dynamics. Conference organizers' pre-event hype about "massive announcements" and high-profile speakers creates unrealistic expectations. This year's roster featured the Trumps alongside crypto influencers and industry veterans promoting familiar narratives about "freedom money" and institutional adoption.

The Asian edition in Hong Kong produced identical results. As speakers including Eric Trump and CZ took the stage, BTC dropped from $115,000 to $108,400, with a 4% overnight decline during the event. Market participants appear to be pricing in the gap between promotional rhetoric and tangible developments.

Investors Withdraw Lawsuit Against Strategy Over Bitcoin Accounting Practices

Investors have abruptly dismissed a proposed class action lawsuit against Strategy, a business intelligence firm, and its executive chairman Michael Saylor. The suit, which accused the company of misleading shareholders about the risks tied to its substantial Bitcoin holdings, was voluntarily withdrawn with prejudice, permanently closing the case.

Filed in May by Pomerantz LLP, the lawsuit alleged that Strategy overstated potential gains from its Bitcoin strategy while obscuring volatility risks and failing to disclose the accounting impacts of new digital asset standards. The plaintiffs' sudden retreat, filed on August 28, offers no public explanation for the dismissal.

The case highlights mounting scrutiny over corporate Bitcoin disclosures as accounting standards evolve. Strategy's high-profile crypto bets, led by Saylor, remain a focal point for investor skepticism and regulatory ambiguity.

Bitcoin Price Drops To 7-Week Low: How Low Could BTC Fall in the Current Pullback?

Bitcoin has slumped below $109,000, marking its lowest level since July 9. The decline raises questions about whether the market is entering a deeper correction or merely cooling off after months of sustained gains. A notable shift is the drop in Bitcoin dominance, historically a precursor to altcoin outperformance.

Analyst Josh highlights weakening buying power as BTC struggles to push higher. The cryptocurrency now hovers just below critical support at $109,000. A breach could see prices test the $105,000-$106,000 zone, a historical cushion during past pullbacks. Resistance looms at $112,000, with a decisive break above $114,800 potentially reigniting bullish momentum toward $117,000.

The MACD histogram remains red, signaling persistent bearish pressure. Price action reflects a stalemate between bulls and bears, with neither faction establishing control. Despite near-term weakness, the broader outlook suggests a pause rather than a collapse.

Cloud Mining Gains Momentum as Accessible Crypto Investment Tool

Cloud mining has emerged as a democratizing force in cryptocurrency investment, lowering barriers to entry for Bitcoin and altcoin mining. Platforms like Cryptosolo now offer daily returns of 3-9% with minimal upfront costs, transforming what was once an infrastructure-intensive process into a passive income opportunity.

The sector's growth reflects broader DeFi trends toward financial accessibility. Cryptosolo, operating since 2020 with FCA certification, exemplifies this shift by providing automated mining contracts starting at $200. Its network of 12 data centers underscores the industrial scaling of cloud mining operations.

Changpeng Zhao Predicts Bitcoin as Future Global Reserve Currency

Bitcoin has demonstrated remarkable resilience since the 2022 FTX collapse, surging over 200% in value. Former Binance CEO Changpeng Zhao (CZ) now forecasts its evolution into the world's reserve currency, citing accelerating institutional adoption.

Traditional finance entities are increasingly incorporating Bitcoin into balance sheets, according to Zhao's August 29th interview. This institutional momentum coincides with bullish analyst predictions reaching $200,000+ price targets, though market realization remains contingent on macroeconomic factors.

The cryptocurrency's post-crash recovery has established a consistent growth trajectory, reinforcing its store-of-value narrative. Zhao's endorsement amplifies growing consensus about Bitcoin's expanding role in global finance.

Gold’s Record Highs Put Bitcoin in the Spotlight for Q4 Rally

Gold’s surge to near-record highs of $3,475 in August 2025 has crypto traders eyeing Bitcoin for a potential Q4 rally. The precious metal’s ascent, driven by sticky inflation, anticipated rate cuts, and geopolitical tensions, mirrors historical patterns where Bitcoin follows gold’s lead with amplified momentum.

Markus Thielen of 10x Research highlights the correlation: Bitcoin, often dubbed 'digital gold,' has tracked gold’s trajectory in 2025, peaking at $124,000 in July before settling near $111,000. A sustained gold breakout could signal Bitcoin’s next leg up, particularly if macro conditions worsen.

AMBTS Raises $23.2M to Build Bitcoin Treasury, Targets 1% of BTC in Circulation

Amsterdam Bitcoin Treasury Strategy (AMBTS), a venture launched by Dutch crypto-asset service provider Amdax, has secured €20 million ($23.2 million) in its initial funding round. The private placement, capped at €30 million ($34.8 million), will close by September 2025. Proceeds will fuel AMBTS's ambition to establish Europe's first independent bitcoin treasury firm, with plans for a Euronext Amsterdam listing.

The long-term vision is audacious: accumulate at least 1% of all circulating bitcoin. Early backers include Marc van der Chijs, founder of bitcoin miner Hut 8, signaling institutional confidence in BTC's store-of-value proposition. This move mirrors growing corporate treasury strategies adopting bitcoin as a reserve asset.

JPMorgan Says Bitcoin Is Undervalued: Could It Hit $126,000?

Bitcoin's risk-return profile is converging with gold, prompting JPMorgan to declare the cryptocurrency undervalued. Analyst Nikolaos Panigirtzoglou projects a year-end fair value of $126,000, citing historically low volatility as the key driver. Annual volatility has halved from 60% to 30% this year, making BTC increasingly compatible with institutional capital allocation strategies.

The volatility ratio between bitcoin and gold has reached record levels, reinforcing their comparison as alternative stores of value. This convergence marks a critical phase in bitcoin's institutional adoption journey. Major allocators are now forced to reconsider BTC's position in portfolios traditionally dominated by precious metals.

Will BTC Price Hit 200000?

Reaching $200,000 is plausible but requires overcoming key hurdles. Currently at $108,285, BTC needs approximately an 85% rally. Technical resistance lies at $122,736 (Bollinger Upper), while support is at $108,021. Factors supporting this target include institutional accumulation (e.g., BlackRock), JPMorgan's $126,000 valuation, and long-term bullish forecasts from figures like CZ. However, short-term headwinds include the conference indicator pattern and recent pullbacks. A timeline of 12-18 months is realistic if institutional adoption accelerates and macroeconomic conditions favor risk assets.

| Target Price | Required Gain | Key Resistance | Timeframe |

|---|---|---|---|

| $200,000 | +85% | $122,736 | 12-18 months |